(Bloomberg) — After the S&P 500 closed at a new record high on Friday, European shares rose amid optimism over interest-rate cuts by the Federal Reserve and as investors awaited a key update on U.S. inflation.

Most Read from Bloomberg

Rate-sensitive real estate stocks led gains in Europe, while oil companies lagged amid weakness in crude prices. After the S&P 500 closed above 5,000 for the first time on Friday, U.S. stock futures were in a narrow range on a renewed rally by major technology companies. Treasury yields were lower, while the dollar was steady after ending a sixth straight week of gains, its longest winning streak since early September.

Tuesday's inflation report is the key event of the week for markets as traders look for clues on the timing of the first central bank rate cut. On Friday, Atlanta Fed President Rafael Bostic said he was “laser focused” on getting inflation back to target, and his Dallas counterpart, Lori Logan, said there was no rush to ease. There's more Fedspeak to look forward to later Monday, with comments from three Fed officials.

“January CPI numbers are expected to be softer compared to December, but with Fed officials cautiously sticking to the script recently, it's hard to think this week's CPI will change the latest news,” said Paul Mackel, head of global FX research. In HSBC Bank Plc. “One would think that many at the Fed would favor a stronger dollar to aid the inflation process.”

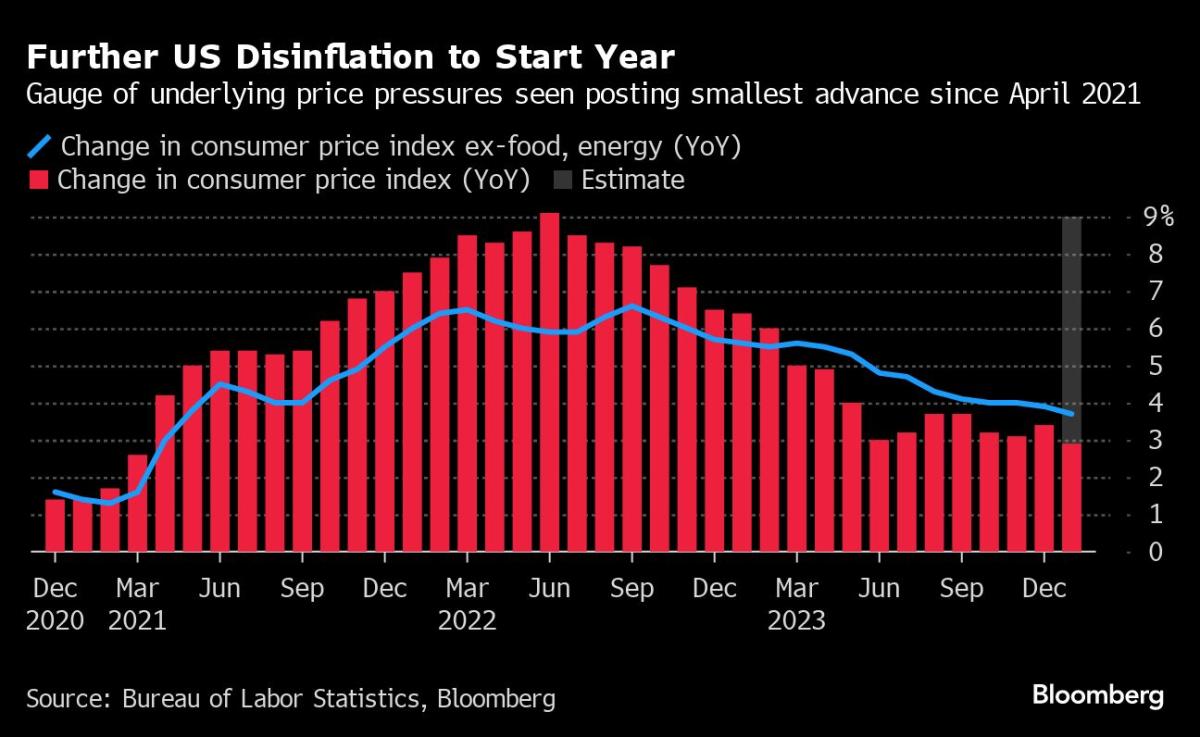

According to a consensus estimate of economists polled by Bloomberg, the annual U.S. inflation rate is forecast to fall to 2.9% from 3.4% in January. This would be the first reading below 3% since March 2021.

The swaps market is pricing in investors expecting a 15% chance of a Fed rate cut in March, up from 65% a month ago. Traders now expect four 25-basis-point rate cuts in 2024, down from seven forecast at the end of last year.

For UBS Global Wealth Management chief investment officer Mark Heffel, the outlook for global bonds remains bright even if the market doesn't get the number of Fed rate cuts it's betting on.

“It's important not to lose sight of the big picture, which is that continued inflation should allow the Fed to begin easing this year,” Heffel wrote in a note. “This is a significant change in the investment landscape, so we think it is less important whether the Fed cuts three, four or five times this year. Either of these scenarios should have a positive macro outcome for bonds, and the 10-year Treasury yield should drop to 3.5% by the end of this year. We see

In Asia Monday, trading levels were muted with a number of markets closed for the Lunar New Year holiday. Stocks in Australia, New Zealand, India and the Philippines fell due to lack of presence in the region. Markets including Japan, China, Hong Kong, Singapore, Taiwan and South Korea were all closed.

The yen hit a two-month low on Friday following comments by central bankers that the Bank of Japan will take time to raise rates. Japan's currency has weakened against all its Group-of-10 peers this year.

Among commodities, oil prices fell following last week's gains, as Iran's foreign minister said the war in Gaza was moving toward a diplomatic solution.

Highlights of this week:

-

CBI of India, Monday

-

Minneapolis Fed President Neel Kashkari, Fed Governor Michelle Bowman and Fed President Tom Parkin will speak on Monday.

-

ECB Governing Council member Piero Cipollone and Chief Economist Philip Lane speak on Monday

-

US CPI, Tuesday

-

UK unemployment, Tuesday

-

Japan producer prices, Tuesday

-

UK Inflation, Wednesday

-

Eurozone GDP, industrial production, Wednesday

-

Indonesia presidential election, Wednesday

-

Bank of England Governor Andrew Bailey speaks on Wednesday

-

ECB Governing Council member Boris Vujcic and Vice President Luis de Guindos speak

-

Chicago Fed President Austin Goolsbee speaks on Wednesday

-

Australia Jobs, Thursday

-

Japan GDP, Thursday

-

UK GDP, Thursday

-

US Initial Jobless Claims, Retail Sales, Thursday

-

Philippine central bank meeting on interest rates, Thursday

-

ECB President Christine Lagarde speaks on Thursday

-

Fed Governor Christopher Waller speaks on Thursday

-

Bank of England policymakers Catherine Mann and Megan Green are speaking on Thursday

-

US housing starts, producer prices, Friday

-

San Francisco Fed President Mary Daly and Fed Vice President for Supervision Michael Barr will speak on Friday.

Some key movements in the markets:

Shares

-

The Stoxx Europe 600 was up 0.3% as of 8:06 a.m. London time.

-

S&P 500 futures were little changed

-

Nasdaq 100 futures were little changed

-

The future of the Dow Jones Industrial Average was little changed

-

The MSCI Asia Pacific Index was little changed

-

The MSCI Emerging Markets Index was little changed

Coins

-

The Bloomberg Dollar Spot Index was little changed

-

The euro was up 0.1% at $1.0796

-

The Japanese yen rose 0.2% to 149.05 per dollar

-

The offshore yuan was little changed at 7.2196 per dollar

-

The British pound was up 0.1% at $1.2643

Cryptocurrencies

-

Bitcoin rose 0.2% to $48,232.01

-

Ether fell 0.2% to $2,500.64

Bonds

-

The yield on 10-year Treasuries fell two basis points to 4.15%.

-

Germany's 10-year yield fell three basis points to 2.35%

-

Britain's 10-year yield fell four basis points to 4.05%.

materials

This story was produced with the help of Bloomberg Automation.

–With assistance from Robert Brandt and Sakharika Jaisinghani.

Most read from Bloomberg Businessweek

©2024 Bloomberg LP