The Walt Disney Company has pulled its channels, including ESPN and ABC stations, from Charter Communications’ Spectrum pay-TV service, which reaches nearly 15 million subscriber homes nationwide.

Thursday night’s blackout on Spectrum came just minutes before kickoff of a highly anticipated college football game between the Utah Utes. and the Florida Gators on ESPN and during Spanish event Carlos Algaraz’s tennis match at the US Open in New York on ESPN2.

Sports fans across the country are furious. “Jeopardy!” Local Spectrum subscribers watching ABC’s broadcast of “Wheel of Fortune” and KABC-TV Channel 7’s “Evidence News” were also out of luck. The channels went dark just before the start of the NFL regular season, consistently the most-watched show on TV. Other channels that will be part of the outage include FX, Freeform, Disney Channel and National Geographic.

“We have been in ongoing negotiations with Charter Communications for some time and have not yet agreed to a new market-based agreement,” Disney said in a statement. “As a result, their Spectrum TV subscribers will no longer have access to our unrivaled portfolio of live sporting events and news coverage, as well as children’s, family and general entertainment programming.”

Charter Spectrum is the largest pay-TV provider in the Los Angeles region. The service has more than 5 million customers in California — about one-third of the nationwide total.

It was unclear Friday how quickly the two sides could resolve the dispute over cab fares and regulations — if they could find a solution at all. Charter Chief Executive Christopher Winfrey told analysts during a morning conference call that a deal should be finalized soon, and that the Burbank entertainment giant should give Charter more leeway in how it offers Disney’s channels on the spectrum.

Otherwise, Winfrey said, Charter is willing to live without Disney’s channels — including ESPN — which could result in a loss of subscribers, accelerating the rapid cord-cutting that has already upended the television business model.

“We’re moving forward with a new collaborative video model, or we’re moving,” Winfrey said. “We’re on the brink of a precipice…the video ecosystem is broken.”

The charter dispute represents the latest significant challenge facing Disney and its chief executive Bob Iger, who returned to the company last November and has been plagued by serious headaches, including twin labor strikes. .

Earlier this summer, Iger said he was considering exiting the pay-TV business, including selling ABC and other networks, because viewers are rapidly shifting to direct-to-consumer streaming services. He also said he was open to taking on a minority strategic partner for ESPN, which would help the sports company transition to a direct-to-consumer model.

But as Iger tries to ease Disney into the streaming era, the old cable and satellite business continues to pay the bills.

The financial basis of traditional entertainment companies, including Disney, is revenue from monthly programming fees paid by Charter and other distributors to carry their channels. Charter said Friday it plans to pay $2.2 billion for Disney’s shows this year.

Disney has long used the power of its ESPN networks to extract premium rates from pay-TV providers. The ESPN networks are considered “must-have” channels, so broadcasters have willingly agreed to pay top dollar — estimated at $9 a month per subscriber household for ESPN channels — to continue carrying them. Rates for most entertainment channels are less than $1 a month per household.

But not all cable customers watch sports.

Under the existing model, subscribers still have to pay for ESPN and other expensive sports channels, leading to widespread cord-cutting as millions of customers flee to lower-cost streaming services.

Over the past five years, 25 million U.S. subscribers have ditched cable — representing nearly a quarter of all subscribers, Charter said.

“It’s staggering,” Winfrey said, adding that the company was motivated to keep the line because it wanted the flexibility to offer “slim” cheaper packages without ESPN in an effort to attract customers who don’t watch sports. Charter prefers to offer comprehensive packages with sports.

On Friday, Disney pushed back against Charter’s claims, saying the Stamford, Conn.-based cable provider “refused to enter into a new contract with us that reflects market-based terms.”

“Contrary to their claims, we have offered Charter very favorable terms on fees, distribution, packaging, advertising and more,” Disney said. “We’ve proposed creative ways to make Disney’s direct-to-consumer services available to their Spectrum TV subscribers, including opportunities for new and flexible packages that will make those services a focal point for consumers to choose from.”

Charter executives said they agreed to Disney’s financial terms but wanted to offer ad-supported versions of Disney+ and ESPN+ to its cable subscribers at no additional cost. In recent years, many of Disney’s biggest hits have gone to its streaming services — and Spectrum customers have helped subsidize those efforts, Winfrey said.

“It is clear at this point that this is not a typical blackout,” noted cable analyst Craig Moffett wrote in a research note. “Charter seems genuinely willing to move away from Disney and the entire linear video model if necessary.”

Wall Street acknowledged the potential ramifications of the dispute. Disney shares fell 2.4% to $81.64. Charters fell 3.6% to $422.32.

In recent years, channel outages have become more frequent as cable companies struggle to control costs. Cable and satellite TV operators fear that big price hikes will encourage more subscribers to switch to streaming.

Charter’s spectrum shutdown isn’t just a cable fee dispute. Since early July, DirecTV customers have been without Nexstar television stations, including KTLA-TV Channel 5 in Los Angeles. Shares of Texas-based Nexstar Media Group fell 13% to $141.50.

Programmers are seeking more revenue to pay the rising TV rights fees demanded by sports leagues to broadcast their games. In the NFL’s most recent deals with broadcasters, which begin this month, the league will nearly double the revenue it collects from broadcasters.

Rob Tun, DirecTV’s chief content officer, said subscribers are fleeing because programmers are pushing higher fees.

“We have a symbiotic relationship where we both benefit,” Tun said. “But they kill the host.”

For Spectrum viewers, the next few weeks could be frustrating.

The NFL season begins next Thursday and Aaron Rodgers is set to make his regular-season debut as the New York Jets on ESPN’s “Monday Night Football” on Sept. 11. Charter has millions of subscribers in New York. Meanwhile, ESPN and ABC are scheduled to air at least 10 college football games featuring top 25 teams Thursday through Monday during the first full weekend of the season. The US Open championships conclude on September 10.

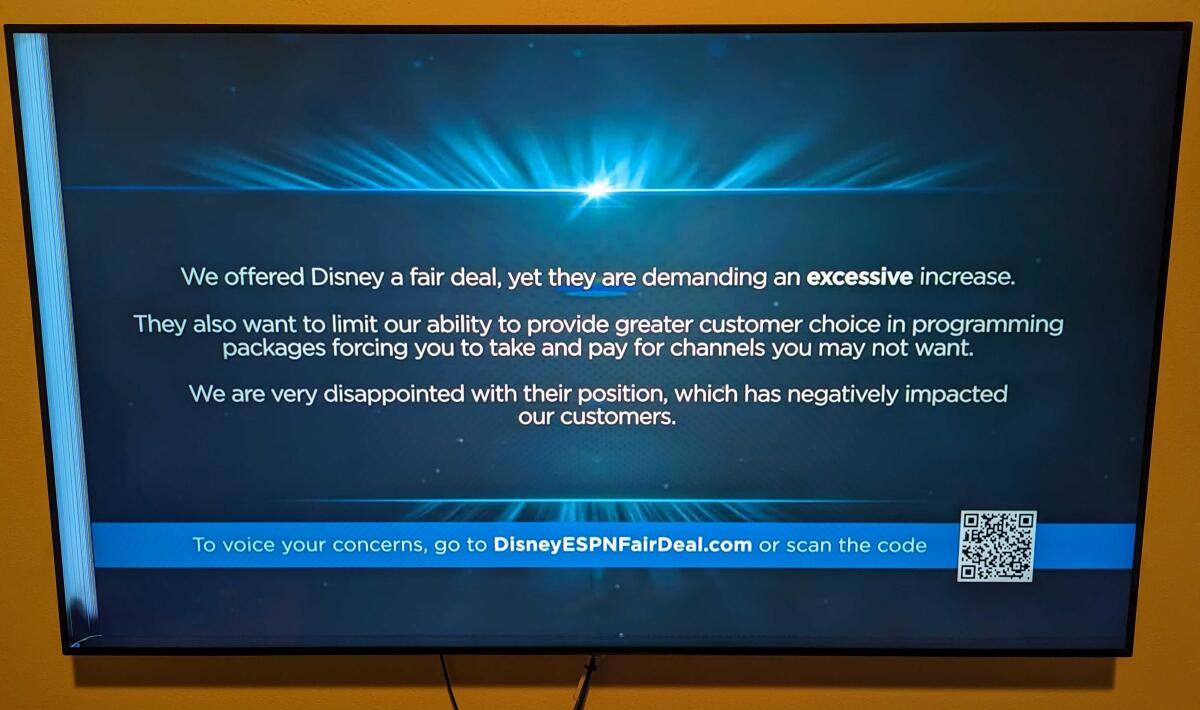

Instead of normal programming, Spectrum subscribers across the country were greeted with a blue screen with text. “We apologize for the inconvenience and continue to negotiate in good faith to reach a fair agreement,” Gabler’s message said, directing subscribers to DisneyESPNFairDeal.com.

Spectrum subscribers trying to watch Disney-owned channels, including ABC and ESPN, were greeted with news of the negotiations.

(Ileana Liman Romero/Los Angeles Times)

Disney signaled Friday that it is not ready to give up one of its most profitable partners.

“We value our relationship with Charter and are ready to return to the negotiating table to restore access to our unrivaled content to their customers as soon as possible,” the company said in a statement. A mutually agreed upon resolution with the Charter.

Times staff writers Stephen Battaglio and Ileana Liman Romero contributed to this report.